Unlocking the US Asset Performance Management Market Value Proposition

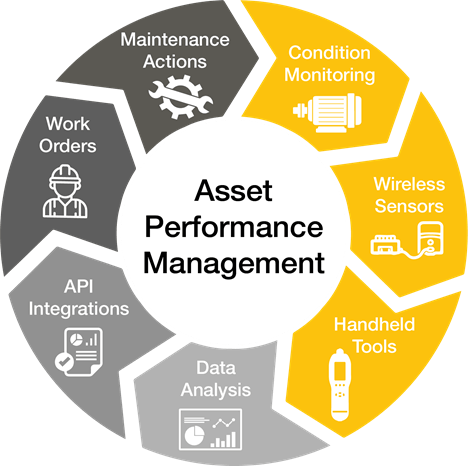

The core of the US Asset Performance Management Market Value proposition lies in its ability to transform industrial operations from a cost center into a strategic, value-generating function. Traditionally, maintenance has been viewed as a necessary expense, but APM reframes it as an investment in reliability and productivity. By leveraging predictive analytics to anticipate equipment failures, organizations can drastically reduce unplanned downtime, which is often the single largest contributor to lost revenue in asset-intensive industries. This shift to proactive maintenance not only safeguards production schedules but also minimizes the high costs associated with emergency repairs, including overtime labor, expedited shipping of parts, and collateral damage to adjacent equipment. The value derived from maximizing asset availability and throughput flows directly to the bottom line, making APM a powerful tool for enhancing profitability and shareholder value in a competitive economic climate.

Beyond the immediate financial gains from reducing downtime, the value of APM extends to the entire asset lifecycle, delivering a compelling return on investment (ROI). By optimizing maintenance strategies and addressing potential issues before they escalate, APM solutions help to extend the operational lifespan of critical, high-value equipment. This deferral of capital expenditure on asset replacement can free up significant funds for investment in other strategic areas of the business, such as research and development or market expansion. Furthermore, condition-based maintenance ensures that resources are not wasted on unnecessary preventative tasks for healthy assets, leading to a more efficient allocation of labor, spare parts, and materials. This holistic approach to asset health management creates a virtuous cycle of cost savings and operational improvements, solidifying the long-term economic value of an APM implementation.

A crucial, though sometimes less tangible, aspect of APM’s value is its significant contribution to improving safety and ensuring regulatory compliance. In industries such as chemicals, energy, and mining, asset failure can have catastrophic consequences for workers, the public, and the environment. APM systems provide an early warning system for deteriorating equipment conditions, allowing companies to take preemptive action to prevent accidents. This proactive stance on safety not only protects human lives but also helps organizations avoid a brand-damaging incident, hefty fines, and potential legal liabilities. By maintaining a detailed audit trail of asset health and maintenance activities, APM platforms also simplify the process of demonstrating compliance with stringent industry and government regulations, reducing administrative burden and mitigating the risk of non-compliance penalties, which adds another layer of financial and reputational value.

Ultimately, the strategic value of APM is realized through its ability to empower data-driven decision-making across the enterprise. The insights generated by an APM platform are not confined to the maintenance department; they provide valuable information for operations, engineering, and even executive leadership. For instance, data on asset reliability can inform future procurement decisions, helping engineers select more robust equipment. Performance metrics can be used to benchmark different facilities or production lines, identifying best practices that can be replicated throughout the organization. By providing a single, unified view of asset health and performance, APM breaks down information silos and fosters a culture of continuous improvement, transforming a company's physical assets from passive components into active contributors to its overall strategic success and long-term resilience.

The US Asset Performance Management market is forecast to experience substantial growth, expanding from a 2024 valuation of $1.2 billion to $2.5 billion by 2035. This growth, occurring at a 6.90% compound annual growth rate, is driven by the clear economic advantages of implementing more efficient and intelligent asset management strategies.

Explore Our Latest Trending Reports:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness