-

Fil d’actualités

- EXPLORER

-

Pages

-

Groupes

-

Evènements

-

Blogs

-

Offres

-

Emplois

-

Courses

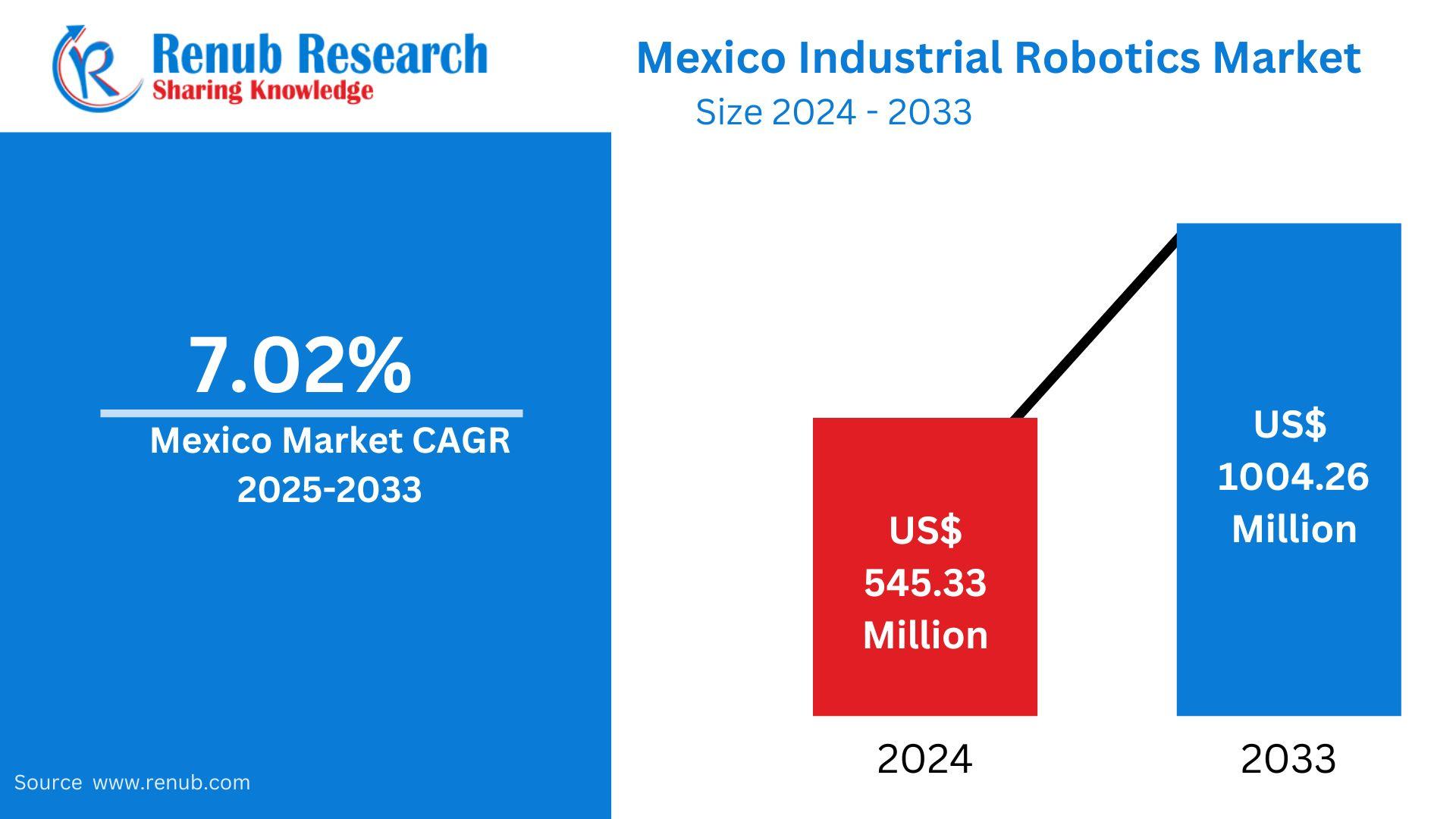

Mexico Industrial Robotics Market Growth to US$1,004.26M by 2033 at 7.02% CAGR

Mexico Industrial Robotics Market Size and Forecast (2025–2033)

According To Renub Research Mexico industrial robotics market is set to experience robust growth over the forecast period from 2025 to 2033. Valued at approximately US$ 545.33 million in 2024, the market is expected to reach around US$ 1,004.26 million by 2033, registering a compound annual growth rate of 7.02%. This expansion is being driven by Mexico’s rapid transformation into a global manufacturing hub, rising adoption of automation across industries, increasing demand for precision and efficiency, and strong investments in automotive, electronics, and metal manufacturing. Supportive government initiatives, the integration of Industry 4.0 technologies, and the need to optimize labor costs while scaling production are further accelerating market growth.

Mexico Industrial Robotics Market Overview

Industrial robotics in Mexico has gained significant momentum as manufacturers increasingly focus on automation to enhance productivity, consistency, and competitiveness. The market includes a wide range of robotic systems such as articulated robots, Cartesian robots, SCARA robots, and collaborative robots, each designed to perform tasks including welding, material handling, painting, assembly, inspection, and packaging.

Mexico’s position as a preferred destination for global manufacturing has played a critical role in robotics adoption. Industries such as automotive, electronics, aerospace, and metal fabrication are at the forefront of deploying robotic solutions to meet international quality standards and high-volume production demands. Robotics is no longer limited to large multinational corporations; mid-sized manufacturers are also beginning to adopt automation to remain competitive in global supply chains.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=mexico-industrial-robotics-market-p.php

Role of Automation in Mexico’s Manufacturing Transformation

Automation has become a strategic necessity for Mexico’s manufacturing sector as companies strive to improve operational efficiency and reduce dependence on manual labor. Industrial robots help manufacturers achieve higher accuracy, repeatability, and throughput while minimizing production errors and downtime. This shift is particularly important in export-oriented industries, where quality consistency and delivery speed are critical.

The adoption of robotics also supports workplace safety by automating hazardous or physically demanding tasks. As manufacturers modernize their facilities, robotics integration is becoming central to long-term operational sustainability and global competitiveness.

Impact of the Automotive Industry on Robotics Demand

The automotive sector is the single most influential driver of the industrial robotics market in Mexico. The country is one of the world’s largest vehicle exporters, with a significant share of production destined for the United States and other global markets. To meet strict quality standards and manage large-scale production, original equipment manufacturers and tier-1 suppliers are heavily investing in robotic systems.

Robots are widely used in automotive welding, assembly, painting, and inspection processes. The presence of major global automakers has further accelerated the adoption of advanced robotics, including collaborative robots that work alongside human operators. Machine vision–enabled robotic arms are increasingly deployed to reduce defects, ensure precision, and maintain compliance with international automotive standards.

Expansion of Industry 4.0 and Smart Manufacturing

The integration of Industry 4.0 technologies is reshaping Mexico’s industrial landscape and driving demand for intelligent robotics. Manufacturers are increasingly combining robotics with digital tools such as the Internet of Things, artificial intelligence, machine learning, cloud connectivity, and real-time monitoring systems. These technologies enable predictive maintenance, energy-efficient operations, and flexible production lines.

Smart factories equipped with interconnected robotic systems allow manufacturers to respond quickly to changes in demand and product customization requirements. Industrial clusters in regions such as Baja California, Nuevo León, and Guanajuato are actively implementing digital twins, centralized robotic control systems, and remote diagnostics, strengthening Mexico’s position as a leader in advanced manufacturing within Latin America.

Influence of Nearshoring and Strategic Location

Mexico’s geographic proximity to the United States has made it a prime beneficiary of nearshoring trends. As global companies seek to shorten supply chains and reduce geopolitical risks, Mexico has emerged as a preferred manufacturing destination. This shift has fueled investments in automation technologies, including industrial robotics, to support higher production volumes and faster turnaround times.

Nearshoring encourages companies to enhance operational efficiency through robotics to remain cost-competitive while delivering consistent quality. Regions such as Guanajuato and Nuevo León have become automation hubs, attracting both domestic and foreign investment. The combination of strategic location and advanced automation strengthens Mexico’s global manufacturing competitiveness.

Workforce and Skills Development Challenges

Despite strong market growth, the shortage of skilled labor remains a significant challenge for the Mexico industrial robotics market. The rapid adoption of robotics has outpaced the availability of trained engineers, technicians, and programmers capable of installing, operating, and maintaining advanced robotic systems. This skills gap can delay automation projects and limit the full utilization of robotic technologies.

Efforts are underway to improve robotics education and technical training through vocational programs, university partnerships, and industry-led initiatives. Expanding access to specialized training will be critical to sustaining long-term growth and maximizing the benefits of automation across industries.

High Initial Investment as a Market Barrier

The high upfront cost of industrial robots and automation systems presents another major challenge, particularly for small and medium-sized enterprises. While robotics offers long-term benefits such as reduced labor costs and improved productivity, the initial investment in equipment, integration, and maintenance can be prohibitive for companies with limited capital.

To overcome this barrier, access to financing solutions, government incentives, leasing models, and public–private partnerships is essential. Addressing cost concerns will play a key role in expanding robotics adoption beyond large enterprises.

Northern Mexico Industrial Robotics Market

Northern Mexico represents one of the fastest-growing regional markets for industrial robotics, driven by its close proximity to the United States and strong manufacturing base. States such as Chihuahua and Nuevo León lead in robotics adoption across electronics, automotive, and aerospace industries. Nearshoring trends have further strengthened the region’s appeal for automation-intensive manufacturing.

Government incentives, workforce development initiatives, and the presence of technology hubs support continued growth. Northern Mexico’s integration into international supply chains positions it as a critical region for advanced industrial robotics deployment.

Central Mexico Industrial Robotics Market

Central Mexico has emerged as a key hub for industrial robotics due to its strategic location and concentration of automotive and aerospace manufacturing clusters. States including Guanajuato, Querétaro, and Aguascalientes are at the forefront of automation adoption, with manufacturers investing heavily in robotic production lines.

Government initiatives promoting Industry 4.0 and digital transformation further support robotics deployment in the region. As a result, Central Mexico continues to attract significant investments and plays a leading role in national industrial automation efforts.

Southern Mexico Industrial Robotics Market

Southern Mexico is gradually increasing its adoption of industrial robotics, particularly in states such as Puebla, Oaxaca, and Chiapas. Although less industrialized than northern and central regions, southern Mexico is witnessing steady growth in robotics use, driven primarily by the automotive, electronics, and food processing industries.

Investments in welding, assembly, and quality control robotics are becoming more common, supported by government programs that encourage technological innovation. Improvements in infrastructure and workforce skills are expected to further accelerate robotics adoption in this region.

Market Segmentation by Industry

The Mexico industrial robotics market is segmented by industry, including automotive, electrical and electronics, metal and machinery, plastics and chemicals, food processing, and other sectors. The automotive industry dominates robotics demand due to high production volumes and stringent quality requirements. Electronics and metal manufacturing are also significant contributors, driven by precision assembly and inspection needs.

Food processing and plastics industries are increasingly adopting robotics for packaging, handling, and hygiene-sensitive operations, reflecting broader diversification of automation use across sectors.

Competitive Landscape and Key Companies

The competitive landscape of the Mexico industrial robotics market includes global and regional players focusing on innovation, system integration, and strategic partnerships. Key companies operating in the market include KUKA, Fanuc, ABB Ltd, Panasonic Corporation, and iRobot Corporation.

These companies compete through technological advancements, localized solutions, and expanded service offerings. Continuous investment in research and development, along with tailored robotics solutions for Mexico’s manufacturing needs, is expected to intensify competition and drive further market growth.

Future Outlook of the Mexico Industrial Robotics Market

The Mexico industrial robotics market is positioned for sustained expansion as automation becomes integral to manufacturing strategy. Growing nearshoring activity, Industry 4.0 adoption, and government support will continue to drive demand for advanced robotics. While challenges related to cost and workforce skills persist, ongoing investments in education, infrastructure, and innovation are expected to mitigate these barriers.

Overall, industrial robotics will play a pivotal role in enhancing Mexico’s manufacturing efficiency, global competitiveness, and long-term economic growth through 2033.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness