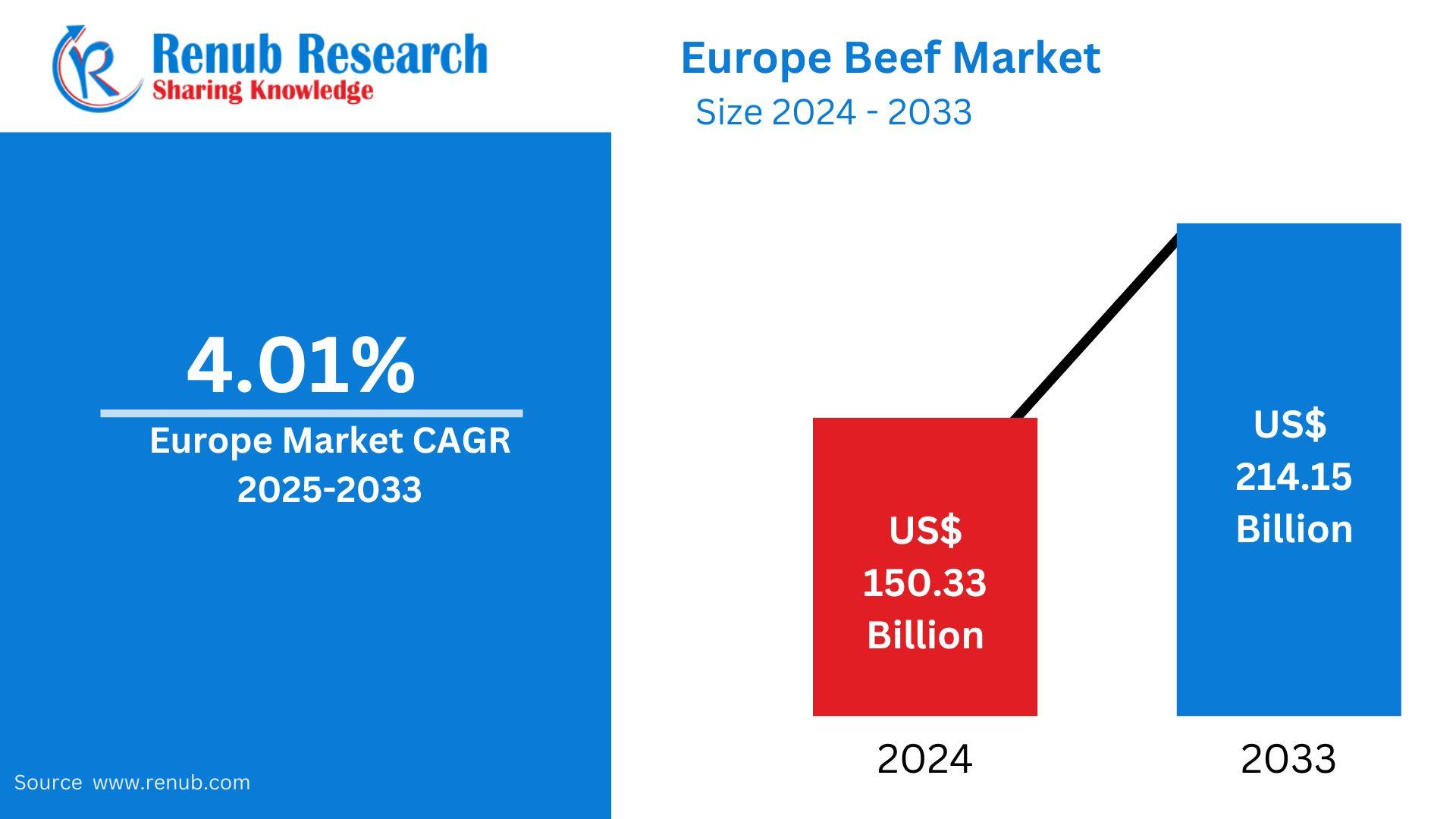

Europe Beef Market to Reach US$214.15 Billion by 2033 at 4.01% CAGR

Europe Beef Market Overview

According To Renub Research Europe beef market is a core component of the continent’s agri-food economy, deeply rooted in long-standing livestock farming traditions, regional cuisines, and well-established trade networks. Beef production and consumption are particularly significant in countries such as France, Germany, Ireland, Spain, and Italy, where cattle farming contributes meaningfully to rural employment and food security. European beef is widely recognized for its high quality, strict safety standards, and robust traceability systems, which are enforced through comprehensive regulatory frameworks and advanced supply chain controls.

Over the years, the market has evolved from volume-driven production toward value-oriented and sustainability-focused models. European consumers increasingly demand transparency regarding origin, animal welfare, and environmental impact. In response, producers and processors have adopted improved labeling practices, certification schemes, and sustainable farming methods. At the same time, the market is experiencing pressure from environmental policies, dietary shifts, and competition from alternative protein sources. Despite these challenges, the Europe beef market continues to demonstrate resilience through innovation, exports, and premium product positioning.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=europe-beef-market-p.php

Europe Beef Market Size and Forecast 2025–2033

The Europe beef market is projected to grow from a valuation of US$ 150.33 billion in 2024 to approximately US$ 214.15 billion by 2033, registering a compound annual growth rate of 4.01% between 2025 and 2033. This steady growth reflects sustained demand for high-quality animal protein, increasing consumption of premium and specialty beef products, and the expansion of export opportunities beyond Europe.

While overall beef consumption growth remains moderate due to health and sustainability concerns, higher-value segments such as organic, grass-fed, traceable, and certified beef are driving revenue expansion. Improvements in meat processing, cold-chain logistics, and packaging technologies are also supporting market growth by extending shelf life and enhancing product appeal. Over the forecast period, the European beef industry is expected to balance moderate volume growth with strong value creation.

Key Factors Driving Growth in the Europe Beef Market

Advancements in Production and Processing Technologies

Technological progress across cattle farming and meat processing has become a critical growth driver for the European beef industry. Precision livestock farming tools, including data-driven herd monitoring, automated feeding systems, and genetic optimization, are improving animal health, productivity, and feed efficiency. These technologies enable farmers to reduce costs while meeting stringent animal welfare and environmental standards.

On the processing side, modern slaughtering, cutting, and chilling technologies ensure consistent product quality, improved hygiene, and full traceability. Automation and digital tracking systems help processors comply with strict European food safety regulations while enhancing operational efficiency. Packaging innovations such as vacuum sealing and modified atmosphere packaging further extend product shelf life and reduce food waste. Together, these advancements strengthen competitiveness and support long-term industry growth.

Expansion of Export Markets

European beef producers are increasingly targeting international markets to diversify revenue streams and reduce reliance on domestic consumption. European beef enjoys a strong reputation for quality, safety, and traceability, making it attractive in premium export markets across Asia, the Middle East, and parts of North America. Rising incomes and growing demand for high-quality protein in these regions create favorable conditions for European exports.

Trade agreements, improved cold-chain infrastructure, and targeted marketing strategies are helping European exporters penetrate new markets. Export growth not only improves profitability but also provides stability against fluctuations in local demand caused by dietary shifts or economic uncertainty. As global demand for premium beef continues to rise, exports are expected to play a larger role in Europe’s beef market expansion.

Innovation and Product Diversification

Changing consumer lifestyles and preferences are encouraging beef producers to move beyond traditional fresh cuts and offer more diversified product portfolios. Value-added products such as marinated beef, ready-to-cook portions, pre-seasoned cuts, and ready meals are gaining popularity among time-conscious consumers. These offerings combine convenience with quality, appealing to urban households and younger demographics.

In addition, demand for organic, grass-fed, locally sourced, and ethically produced beef is rising across Europe. Producers are leveraging these trends to differentiate their brands and command premium pricing. By investing in innovation and product differentiation, beef companies can enhance customer loyalty, reach new consumer segments, and mitigate the impact of declining traditional beef consumption.

Challenges in the Europe Beef Market

Environmental and Sustainability Pressures

Environmental sustainability is one of the most significant challenges facing the European beef industry. Beef production is often associated with greenhouse gas emissions, high land use, and water consumption. As climate change mitigation becomes a priority, beef producers are under increasing pressure to reduce their environmental footprint.

European policies such as the Green Deal and Farm to Fork strategy promote lower emissions, sustainable land use, and reduced environmental impact across the food system. Compliance with these initiatives requires investment in carbon-efficient feed, regenerative grazing practices, manure management systems, and improved resource efficiency. While these measures are essential for long-term market access and public acceptance, they can increase costs and complexity for producers.

Shifting Consumer Preferences

European consumers are becoming more health-conscious and environmentally aware, leading to changes in dietary habits. Red meat consumption has declined in several countries as consumers reduce portion sizes, adopt flexitarian diets, or shift toward plant-based protein alternatives. This trend is particularly evident among younger consumers and urban populations.

In response, beef producers face the challenge of maintaining relevance in a market increasingly focused on sustainability and wellness. Offering leaner cuts, transparent labeling, organic certification, and hybrid products that combine meat with plant ingredients are some strategies being adopted. Successfully adapting to evolving consumer preferences is essential for sustaining demand and long-term growth.

Europe Beef Market Overview by Country

Germany Beef Market

Germany is one of Europe’s largest beef markets, supported by a well-developed retail sector and strong consumer demand for premium meat products. German consumers increasingly prioritize animal welfare, environmental sustainability, and product transparency, driving growth in organic and certified beef segments. Retailers play a key role in shaping demand through private labels and sustainability-focused product lines.

Despite these strengths, beef consumption per capita in Germany has been gradually declining, and producers face rising costs related to feed, energy, labor, and regulatory compliance. Occasional livestock disease outbreaks and supply chain disruptions further challenge the market. Nevertheless, ongoing investment in traceability systems, local sourcing, and digital retail platforms continues to support market adaptation.

France Beef Market

France is one of Europe’s leading beef producers, renowned for premium cattle breeds such as Charolais, Limousin, and Blonde d’Aquitaine. The French beef market places strong emphasis on quality, origin, and traceability, supported by detailed labeling requirements that highlight breed, farming methods, and animal welfare standards.

Sustainability initiatives are increasingly integrated into French beef production, including optimized grazing systems and reduced transportation distances. However, the market faces challenges such as declining production volumes, reduced farmer profitability, and growing competition from lower-cost imports. Despite these pressures, France continues to innovate through cooperative farming models, value-added beef products, and alternative protein integration.

Italy Beef Market

Italy’s beef market is shaped by its rich culinary heritage and preference for high-quality, traceable meat. Native breeds such as Piedmontese and Chianina are highly valued and form the basis of iconic dishes. Italian consumers place importance on taste, origin, and traditional production methods.

However, beef consumption per capita in Italy has declined significantly over the past decade due to health concerns and dietary shifts toward plant-based foods. Italy also relies heavily on imports, particularly live cattle from neighboring countries. Despite these challenges, the beef sector remains an important part of Italy’s agricultural identity, with continued efforts to align production with sustainability goals and evolving consumer expectations.

United Kingdom Beef Market

The United Kingdom beef market is characterized by strong demand for premium and ethically sourced products alongside ongoing structural challenges. Consumers increasingly seek assurances related to animal welfare, local sourcing, and environmental responsibility, prompting producers to emphasize quality differentiation and certification.

At the same time, the sector faces rising production costs, labor shortages, and supply chain disruptions. Changing dietary habits, including reduced red meat consumption among certain consumer groups, also affect demand. Despite these pressures, the UK beef market continues to adapt through innovation in sustainable farming, branding, and value-added product development.

Latest Developments in the Europe Beef Market

Recent developments in the Europe beef market highlight the industry’s focus on traceability, sustainability, and operational efficiency. Strategic partnerships and technology-driven initiatives aimed at improving cattle verification, data sharing, and supply chain transparency are gaining traction. These efforts support faster response to food safety concerns, enhance consumer trust, and add value for producers and processors.

In parallel, investments in sustainable farming practices and digital monitoring tools are helping the industry align with environmental goals while maintaining productivity. Such developments reflect the sector’s commitment to modernization and long-term resilience.

Europe Beef Market Segmentation Overview

The Europe beef market is segmented by cut into brisket, shank, loin, and other cuts, catering to diverse culinary preferences and consumption patterns. By slaughter method, the market includes halal, kosher, and conventional processes, reflecting Europe’s cultural and religious diversity.

Distribution channels include supermarkets and hypermarkets, retail stores, wholesalers, e-commerce platforms, and other channels. Supermarkets and hypermarkets dominate sales due to wide product availability and strong private-label offerings, while e-commerce is gaining traction for premium and specialty beef products.

Geographically, the market spans major European countries including France, Germany, Italy, Spain, the United Kingdom, Belgium, the Netherlands, Poland, and others, each with distinct consumption trends and regulatory environments.

Competitive Landscape of the Europe Beef Market

The European beef market is competitive and fragmented, with global meat processors, regional producers, and cooperative groups operating across the value chain. Companies compete on quality, sustainability, traceability, pricing, and brand reputation. Strategic priorities include capacity optimization, product innovation, export expansion, and compliance with evolving regulatory standards.

Overall, the Europe beef market is expected to maintain steady growth through 2033 by balancing premiumization, sustainability initiatives, and innovation. While challenges related to environmental impact and changing consumer preferences persist, the industry’s ability to adapt positions it for continued relevance in Europe’s evolving food landscape.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness